Digital Currency Grift

Borrow customer funds, buy back stock. Seems reasonable, until you have to pay people back...

The Digital Currency Group (DCG) has long been a darling of the crypto industry. Led by early Bitcoin adopter Barry Silbert, DCG acts as the parent company for a group of crypto-related firms that touch on every aspect of the “crypto-conomy.” One of the major components of this business is Genesis Trading, a “global leader in institutional digital asset trading, derivatives, lending and custody services.” One component of Genesis Trading is Genesis Global Capital, a crypto lending firm that managed funds for other institutional partners. One of the largest of these customers was the Gemini exchange, which operated its own “yield” program targeted at retail investors.

Genesis and DCG were long assumed to be one of the most reputable and rock-solid entities in crypto. After all, Genesis is a licensed and regulated broker-dealer. DCG also owns the Greyscale series of publicly-traded cryptocurrency trust products, which has been a cash cow for the overall business. Thus, industry insiders were not surprised when Genesis Trading took to Twitter on November 8th to announce that they had “no material net credit exposure” to the collapse of the FTX exchange:

However, the next day they amended this statement to endorse $7 million in net losses from “hedging:”

By November 10th, Genesis admitted they had $175 million in assets locked on the FTX exchange:

And on November 16th, Genesis’ lending arm announced they were freezing customer withdrawals due to the “extreme market dislocation and loss of industry confidence caused by the FTX implosion:”

Now, Genesis and its parent company Digital Currency Group are desperately seeking a bailout to the tune of $1 billion. According to reporting from multiple sources, DCG has been turned down by everyone from the Binance exchange to Wall Street vulture private equity firms. In the meantime, the customers of firms like Gemini are unable to recover their funds. Gemini customers alone are owed some $700 million.

Why have DCG and Silbert struck out? It turns out that behind the scenes, DCG has engaged in financial chicanery to keep the company afloat…

What is the Digital Currency Group?

DCG was founded and is led by Barry Silbert, an early adopter of Bitcoin and the founder of a company called Restricted Stock Partners, later called Second Market. In a bit of foreshadowing, Mr. Silbert built his first business trading in illiquid stock from distressed and bankrupt companies. In 2013, Silbert decided to pivot to investing and trading in Bitcoin. He created the created the “Bitcoin Investment Trust (BIT),” a vehicle to facilitate accredited investors’ speculation on Bitcoin. Rebranding his firm as Digital Currency Group, Silbert later spun off the non-crypto portion of the business and sold it to Nasdaq in 2015.

Barry Silbert’s empire is based around his… diversified… collection of cryptocurrency-related companies:

Greyscale, the crown jewel of his holdings, operates a number of publicly-traded trusts that hold cryptocurrency assets like Bitcoin, Ether, and other coins.

Genesis operates (operated?) both as an over-the-counter cryptocurrency exchange as well as offering staking and lending services.

Foundry provides services to cryptocurrency mining firms, particularly Bitcoin

Coindesk, one of the leading media outlets focusing on cryptocurrency

Luno, a “leading” cryptocurrency exchange based in Singapore

Venture investments in dozens of other firms

DCG’s balance sheet is a black hole of intercompany loans

Today, a letter from CEO Silbert to his shareholders was leaked. In it, Silbert provided some fascinating details about the inner workings of DCG.

It has been known for a while that Genesis Trading might be in trouble. Genesis had massive exposure to the collapse of 3AC, being owed some $1.2 billion. To save Genesis, DCG filled the hole in their balance sheet by assuming responsibility for this loss. It turns out that DCG didn’t fill this hole with cash; instead, DCG issued a promissory note for $1.1 billion to Genesis. Separately, DCG owes a group of investors $350 million borrowed via a secured lending facility.

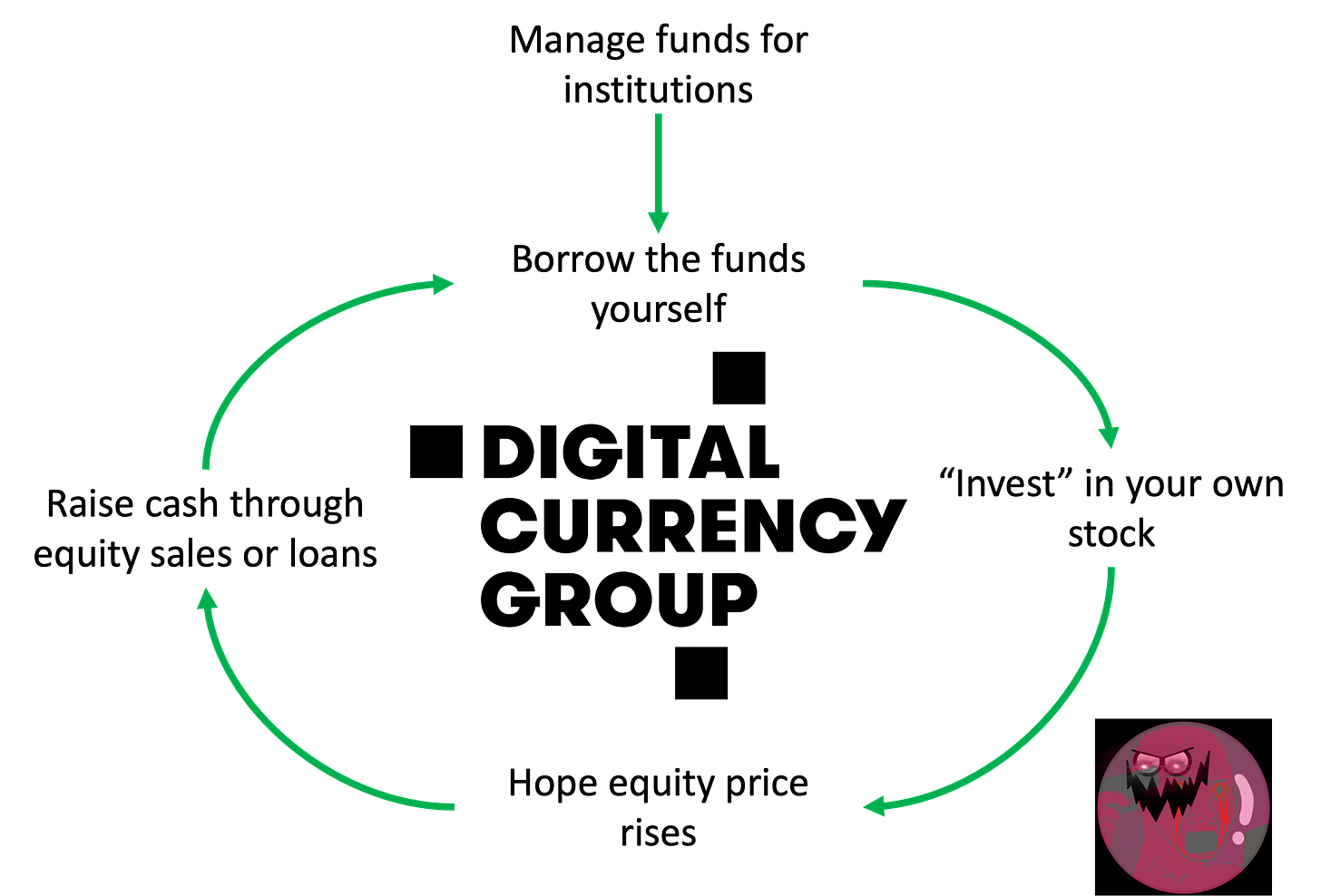

Silbert also disclosed that DCG had borrowed $575 million from its subsidiary Genesis Capital to

fund investment opportunities and buy back DCG stock from non-employee shareholders…

Of course, these loans were

always structured on an arm’s length basis and priced at prevailing market rates.

The ostensible purpose of Genesis Global Capital was to lend their customers’ assets in a way that would generate financially productive transactions and provide sustaininable yield. Instead, DCG appears to have used these assets as a piggy bank to prop up their firm’s equity. This strategy resulted in a predictable outcome: Since the funds were not used for economically productive purposes, the firm no longer has funds to pay back their customers. All they have is illiquid stock in a company teetering on the brink of insolvency.

It’s worth repeating this to make clear just how ridiculous this decision was: Genesis borrowed funds from groups like Gemini, largely generated from unlocked deposits by retail customers. This meant that, at any time, Genesis could expect large withdrawals of those funds to occur. Instead of investing in liquid assets or lending those funds to other solvent trading firms, DCG took the money for themselves and plowed it into totally illiquid investments!

This is the same mistake we have seen others in the crypto industry make. Celsius Network, the failed crypto lender, used hundreds of millions to billions of dollars in customer funds to invest in Bitcoin mining, purchase other companies, and buy back illiquid CEL tokens. FTX did something similar, as it appears SBF “borrowed” his customers’ money to make venture capital investments. This is a major problem and demonstrates gross managerial incompentence.

Greyscale > Everything else

Silbert’s letter also states that DCG is:

pacing to do $800 million in revenue this year.

Ignoring the obvious question— how much is your NET income?— there is another interesting point: It appears that DCG’s Greyscale trust products generate most of this revenue. According to the most recent 10Q filings for their two largest trusts, the Greyscale Bitcoin and Ethereum trusts, the two trusts respectively generated $302 million and $128 million in fees between January and September of 2022. Extrapolate out another quarter, and roughly DCG could expect these two trusts alone to generate nearly $600 million in revenue this year or roughly 75% of DCG’s total expected revenue. This does not include the roughly dozen other trust products offered by DCG that likely generate another $10-20 million in fees.

In other words, in revenue terms Greyscale is basically all of DCG! All the rest of their companies— Genesis, Coindesk, Foundry, etc. — are relatively minor components of their business. Yet it appears Genesis has been such a disaster that it has potentially led to insolvency.

This also raises an interesting question: Greyscale operates a relatively simple model of buying and holding crypto assets and collecting a nice fee for that service. It can’t cost much to run Greyscale… so what exactly has DCG been doing with the revenue from their Greyscale products and the capital they have raised by equity sales and debt issuances?

The evolution of tweets mentioned is astounding:

11/8: Everything is awesome!

11/9: The tiny bit of exposure we have is equivalent to loose change found in the couch

11/10: Huh, that was the biggest couch we've ever seen!

11/16: Genesis cannot come out and play now.

The crypto ecosystem makes me feel so dirty right now. Are there any adults in the room?