How Celsius Works, Part 1: The Zero-Sum Debt Machine

Endless rehypothecation, multiple counterparty risks, unsecured debts, oh my!

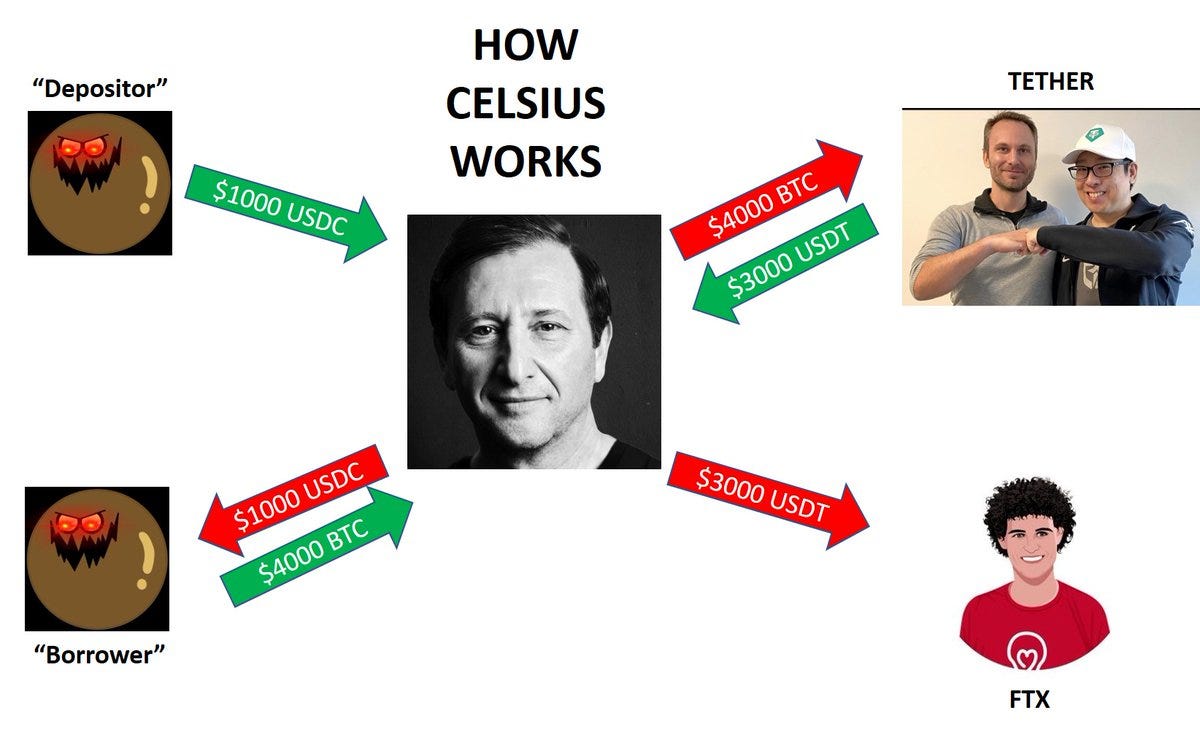

Since we now know that Tether is at least partially backed by crypto loans from Celsius Network, let’s take a look at how this relationship might be structured, and what that means for Celsius’ individual customers.

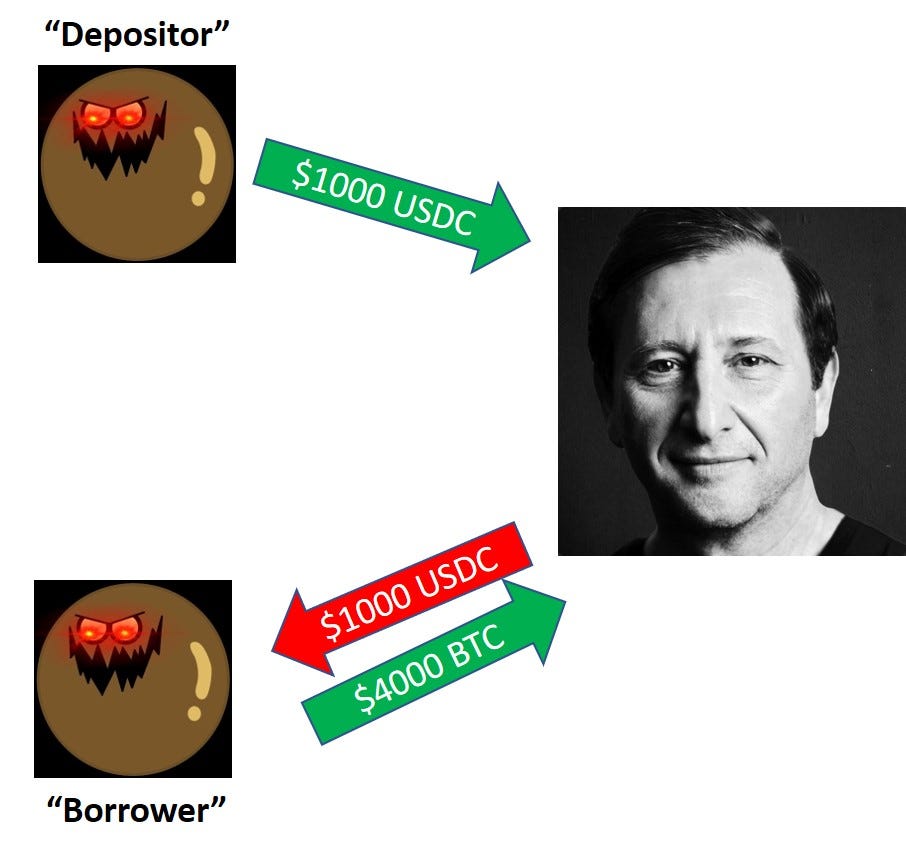

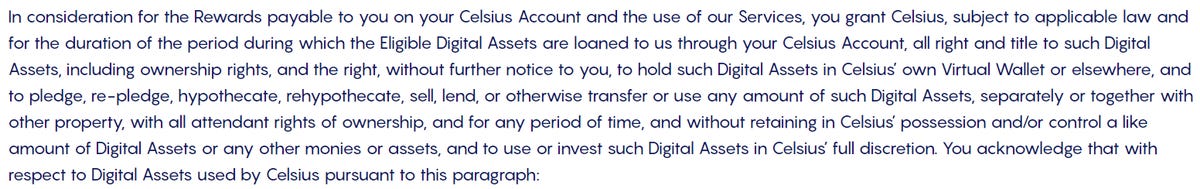

First, a "depositor" gives Celsius $1000 USDC in return for 8.88% APR. These rates are subject to change weekly, but rates on stablecoins in 2021 typically stayed between 8-10%. Remember, per user agreement, there are no "deposits" at Celsius. Any funds transferred to Celsius are considered an unsecured and uninsured loan.

Next, an individual borrows $1000 USDC from Celsius. To get 1% APR, the borrower provides $4000 of Bitcoin collateral.

Per the Terms of Service agreement, Celsius takes IMMEDIATE possession of the collateral. In other words, when you "borrow" from Celsius, you are actually net loaning THEM money!

Celsius then uses the $4000 in Bitcoin collateral to obtain a loan from Tether.

Per Mashinsky’s comments in the Financial Times, they "overcollateralize" these loans by 30%, so they would receive $3000 USDT in return.

Finally, Celsius can lend the $3000 in Tether to an institutional partner like FTX or Binance. Mashinsky has admitted that many of these loans are unsecured.This means that #celsiusnetwork must generate the majority of its returns from this final USDT loan of $3000.

In this scenario, Celsius has to generate enough returns on $3000 Tether to pay:

1. 7.88% APR on $1000 USDC to the depositor

2. ?? % APR on $3000 USDT to Tether

Assuming Tether charges a 6% rate, Celsius would need to charge over 8% to its institutional client just to break even. Celsius claims to pay out 80% of returns to customers, retaining the other 20% to cover costs and generate profit, meaning that in practice Celsius would need to be charging >10% to their institutional borrower.

To confirm if Celsius meets the criteria of a Ponzi scheme, we would have to know the APR charged by Tether to Celsius, and the rate Celsius charges its institutional borrowers. At a minimum, Celsius Network is a highly leveraged debt machine that is exposed to multiple counterparty risks.

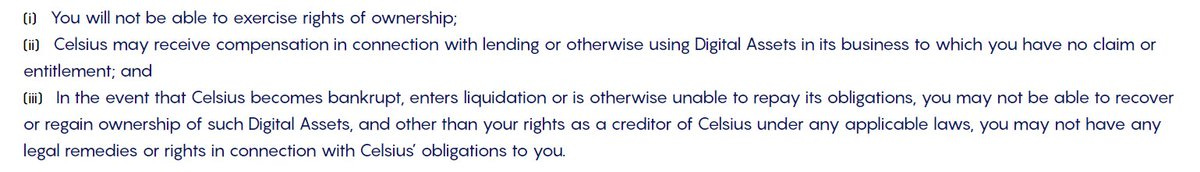

Importantly, the individual account holders in this situation- both depositors and borrowers- are unsecured creditors of Celsius Network. This means they occupy the unenviable position of being last in line to recoup losses in the event the debt machine malfunctions.

Amazing article. Truly mind-blogging you are one of the only publications talking about this stuff.

Just found you today from your interview with Laura Shin Awesome so far. Going through everything.