The FTX-Belarus Connection: ZUBR.io (UPDATED)

In 2021, FTX purchased an obscure Gibraltar-register derivatives exchange tied to binary options, a dodgy crypto exchange, and one of the richest men in Russia.

Note: After this was published, Mr. Prokopenya made public statements to the effect that he was never a direct shareholder in ZUBR Exchange. We derived our belief that he was from previous news reports. We apologize for the error. However, we note the very close relationship between Mr. Prokopenya and Mr. Gutseriev, as well as the multiple connections between ZUBR and Mr. Prokopenya’s other entities.

Several days ago, the Wall Street Journal published in-depth look at the relationship between Sam Bankman-Fried (SBF) and a group of Kazakhstani businessmen. SBF invested over $1 billion into Genesis Digital Assets, a Cyprus-based Bitcoin mining firm with the majority of its operations based in Kazakhstan. As part of that investment, FTX paid $550 million for shares in the company in early 2022. Some 70% of that was paid to one Rashit Makhat, a Kazakhstani oligarch with close ties to the ruling regime. SBF even met with the president of Kazakhstan as part of a mission to sell the company on crypto.

It turns out that Genesis Digital Assets is not the only link Mr. Bankman-Fried and FTX established with well-connected oligarchs. Another example is the now-defunct crypto derivatives exchange ZUBR.io. In 2021, it was announced that FTX had purchased the Gibraltar-registered ZUBR exchange for $11 million. FTX subsequently used ZUBR as a vehicle to obtain a derivatives exchange license in Gibraltar.

It appears that ZUBR was intended to be one component of FTX’s European expansion. By obtaining the Gibraltar license, ZUBR was able to offer futures contracts to European customers. It is unclear how active ZUBR ever was; by the time Gibraltar rescinded their license to do business, regulators stated that ZUBR had no active customers.

So, where did ZUBR come from? The answer is a collaboration between a Belarusian binary options and crypto “billionaire” and his former business partner, the son of one of Russian’s wealthiest oligarchs….

ZUBR and Viktor Prokopenya

FTX purchased the ZUBR exchange from VP Capital, an investment firm controlled by the Belarusian entrepreneur Viktor Prokopenya. (According to Mr. Prokopenya, he never held shares in ZUBR and FTX purchased the company directly from his business partner, Mr. Guseriev. However, we note the interesting connections between ZUBR and Prokopenya’s other entities below.)

Prokopenya is an interesting figure. A Belarusian tech entrepreneur, he first grew wealthy by building and eventually selling the software company Viaden Media to the Israeli gambling giant Playtech. Prokopenya next founded exp(Capital), a “market-making software development company” that was later sold to another online gambling enterprise. Today, Prokopenya operates his companies through his eponymous investment firm.

VP Capital currently lists two major holdings: Capital.com and Currency.com. Capital.com, a Cyprus-registered financial company, offers “contracts for difference” (CFD) instruments. CFDs, a more complex version of binary options, enable people to gamble on price fluctuations in wide variety of securities, currencies, and commodities. CFDs are illegal in the United States due to their substantial potential for ruining inexperienced investors, as well as the regulatory difficulties presented by these types of investment contracts. Since CFD instruments are cash-settled and have no link to the underlying asset, CFD firms essentially operate as bucket shops.

The CFD industry is rife with fraud and ties to organized crime. As we previously reported, FTX built a significant part of its European operations on top of another Cyprus-based CFD trading business with ties to a major fraud ring:

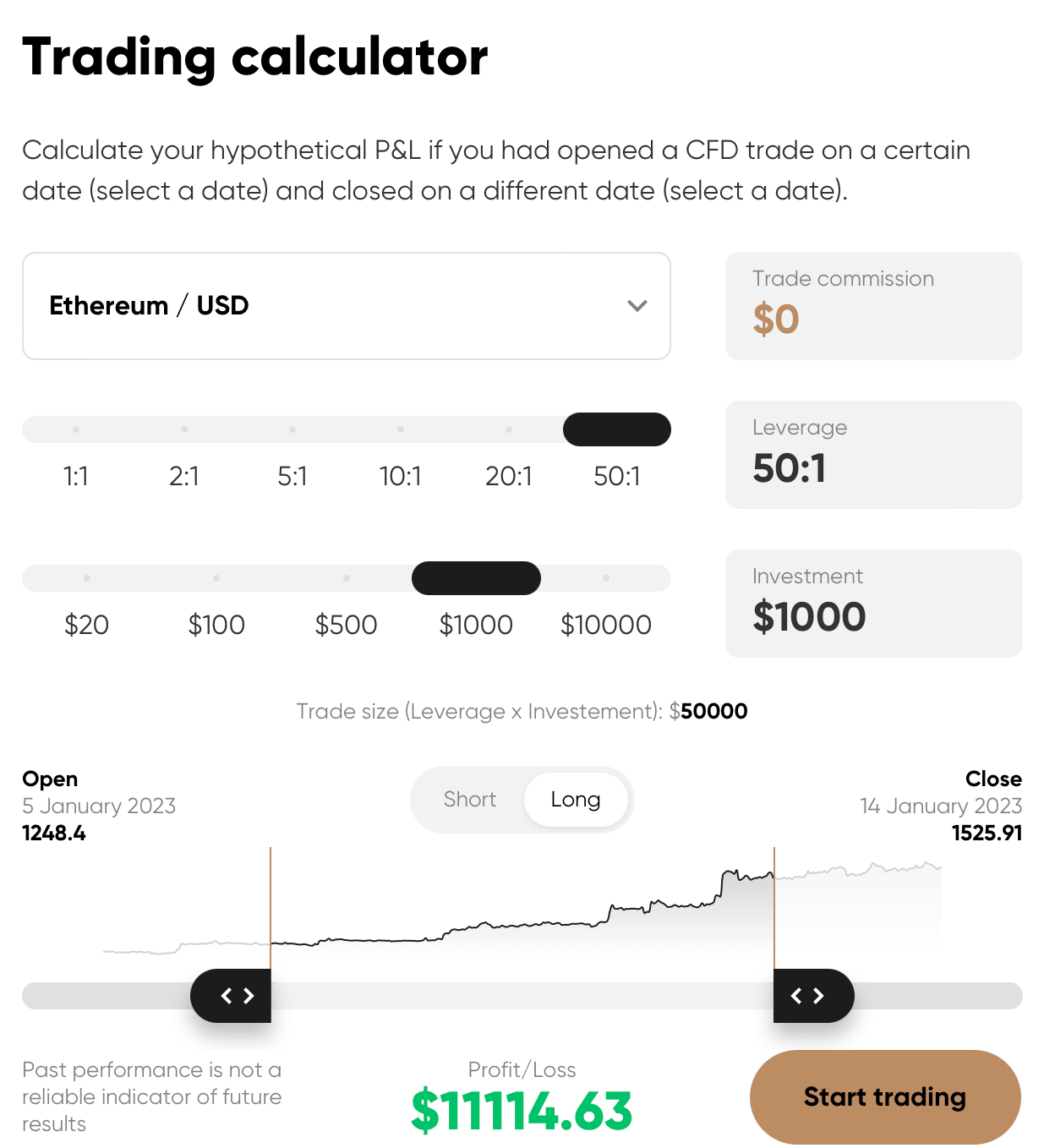

On its homepage, Capital.com invites its prospective customers to calculate how much they can make by trading CFDs on 50:1 leverage:

Prokopenya’s other business, Currency.com, is a cryptocurrency exchange that is based on the same software architecture as Capital.com. Apparently Currency.com is “the best cryptoexchange” according to the “Blockchain Life Award International (2019). Surprisingly, we have never heard of the “Blockchain Life Award International….”

In addition to cryptocurrency assets, Currency.com offers “tokenized Apple shares” and “tokenized Gold.” Currency.com also offers “up to 20x leverage” on its trading platform:

Currency.com is registered in multiple jurisdictions including Gibraltar, the Cayman Islands, and the United States. It is interesting to note that both ZUBR.io’s parent company, 4step.inc, and Currency.com list their registered offices at the same address in St. Vincent and the Grenadines: “First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent & the Grenadines.”

Notably, there are multiple binary options and cryptocurrency firms registered to the same address with names like “Azaforex,” Olymp Trade,” “USP Capital,” and the “MXC Foundation.” There appears to be at least one other questionable cryptocurrency exchange with Russian leadership, “Pointpay,” registered to the same address:

Signature Bank makes another cameo…

We recently obtained and released a list of Signature Bank’s Signet blockchain clients from November 2021. Among the clients is one “Currency Com LTD.” We note that this is the same name as Currency.com’s Gibraltar corporation.

Said Gutseriev: Heir Apparent to One of Russia’s Biggest Oligarchs

Shortly before FTX’s acquisition of ZUBR, Prokopenya had bought out his partner in ZUBR, Capital.com and Currency.com. This partner’s name is Said Gutseriev.

His father, Mikhail Gutseriev, is one of the wealthiest oligarchs in Russia. He controls the Safmar Group, a conglomerate controlling major oil production and mining operations in Russia, Belarus, Azerbaijan, and Kazakhstan. In 2006, he fled Russia after allegations of tax evasion. However, he returned in 2010 with the charges dropped and his sins apparently forgiven.

Mikhail is a major investor in Belarus and close friends with the president of Belarus, Alexander Lukashenko. These ties are so close that in August 2021, Mikhail was personally targeted as part of wider sanctions against the Lukashenko regime.

Said was principally educated in the U.K. and briefly worked for the commodities giant Glencore. He received international media attention in 2016 after his father paid an alleged $1 billion for his wedding. The wedding featured Sting, Enrique Iglesias, and Jennifer Lopez as live entertainment.

After his wedding, Said followed his father into the business world. He is a director on the board of several of his father’s companies. Said was also a close associate of Mr. Prokopenya, having been “50-50 partners” in multiple ventures including ZUBR, Capital.com and Currency.com. However, it appears that Prokopenya bought out Said and removed all mention of him from their businesses after the sanctions against Mikhail were announced. Said himself was later sanctioned in 2022 after the Russian invasion of the Ukraine.

In contrast to the Gutseriev family, Prokopenya has been staunchly pro-Western in his outlook. In 2015, he was arrested in Belarus and released for actions against the regime. He then moved to London and apparently has lived in the UK since that time. After the Russian invasion of the Ukraine, Currency.com stopped providing services to Russian clients.

Another rabbit hole….

As always, our digging leaves us with more questions than we started with. How did FTX end up buying the obscure ZUBR exchange? Was it an accident that FTX ended up doing business with yet another organization participating in the problematic binary options industry? And what other strange relationships are still undiscovered within the investments FTX made prior to its collapse?

I love reading your articles :) you rock

Not a well researched article. In particular, none of the oligarchs in question are anywhere remotely "one of the wealthiest oligarchs in Russia". It isn't even clear they are Russian as opposed to Kazakh or something else.

Stick with the real facts of the case instead of click bait headlines.